These are the details of a solution for item 8 (Bond Verification) described in SuretyScience's Surety Blueprint™. Currently, bond verification and status checks largely depend on direct outreach to insurers, often through phone calls, emails, or manual requests. This process is time‑consuming, inconsistent, and inefficient for obligees, principals, agents, and other stakeholders who need timely confirmation. Despite years of discussion and multiple industry initiatives, the surety market has yet to deliver a simple, standardized solution that enables universal, self‑service, real‑time bond validation.

Ongoing Efforts

Methodologies

Several approaches have been explored as potential universal solutions for verifying surety bonds. However, none have achieved widespread adoption or emerged as a de facto standard.

Challenges

While this is the simplest and most intuitive solution, it has never gained traction due to a lack of standardization, agreed‑upon processes, and data uniformity. Until recently, there has also been no clear industry champion for this approach.

Challenges

Widely utilized for bid bonds. If all surety bonds were bound through bond authenticators, verification by these vendors would represent an obvious and efficient solution. However, adoption for contract bonds has progressed slowly due to legal requirement and higher risk. Additionally, the process is not well suited for high‑volume, low‑risk commercial transactional bonds, where efficiency, automation, and speed are critical.

Challenges

Adoption has been hindered by underfunded initiatives and weak execution. Centralized database models struggle due to sureties’ reluctance to expose bond‑level data, and recent blockchain‑based approaches have added unnecessary complexity and misaligned with practical industry needs.

Universal Surety Bond Number (USBN)

Because insurers may use similar or overlapping bond numbering schemes, a standardized approach to identification is essential. The proposed Universal Bond Number (USBN) is composed of three elements. First is an identifier that specifies the verification method to be used. Second is the universal Legal Entity Identifier (LEI) of the insurer, bond authentication vendor, or consortium—a 20‑character code based on the ISO 17442 standard developed by the International Organization for Standardization (ISO). Third is the bond number assigned by the insurer’s surety bond execution system. The USBN also streamlines insurer self‑verification by eliminating the need to specify the insurer when searching for a bond number.

Identifier Specifying the Bond Verification Method

Global Identifier (LEI Number) of an Insurer, Vendor or Consortium

The Surety Bond Number Assigned By An Insurer During Issuance

USBN Example

1

84930FMNXYF84V5YF2

B2448910

The Insurer Self-Verification Method

SuretyScience strongly supports insurer‑based bond verification as the optimal industry solution.

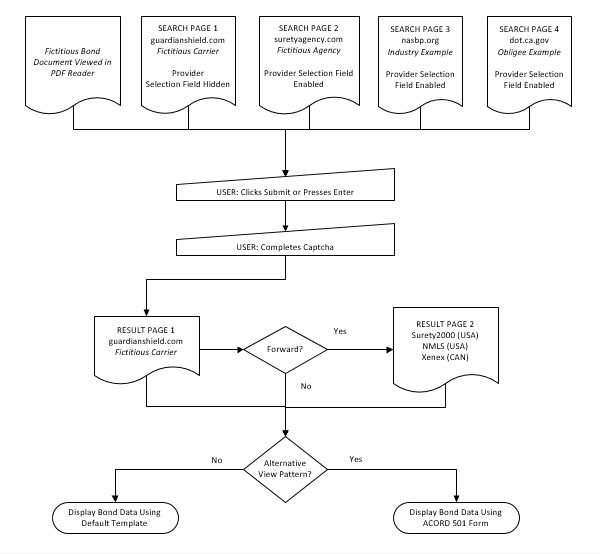

The Process

Insurer Bond Self-Verification Benefits

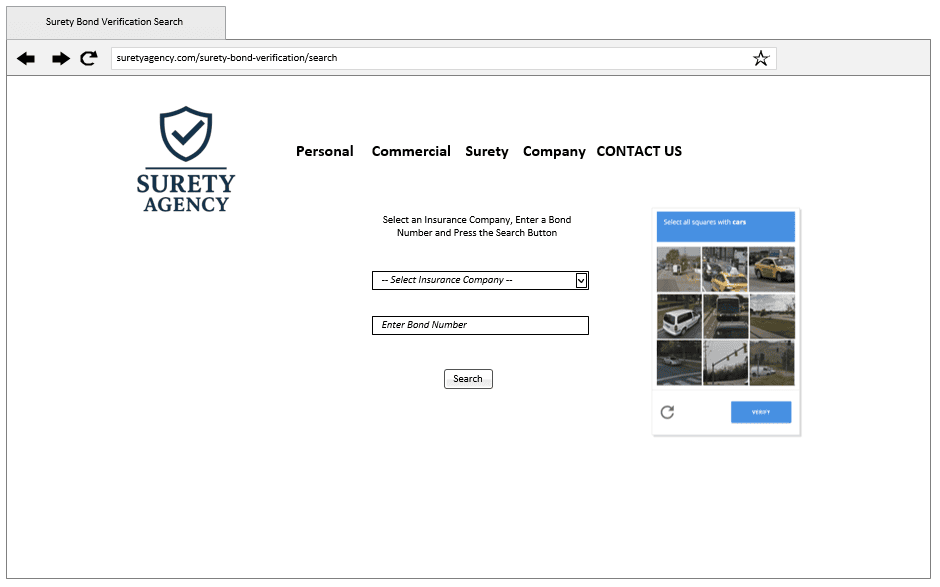

Insurer Bond Self-Verification Screenshots

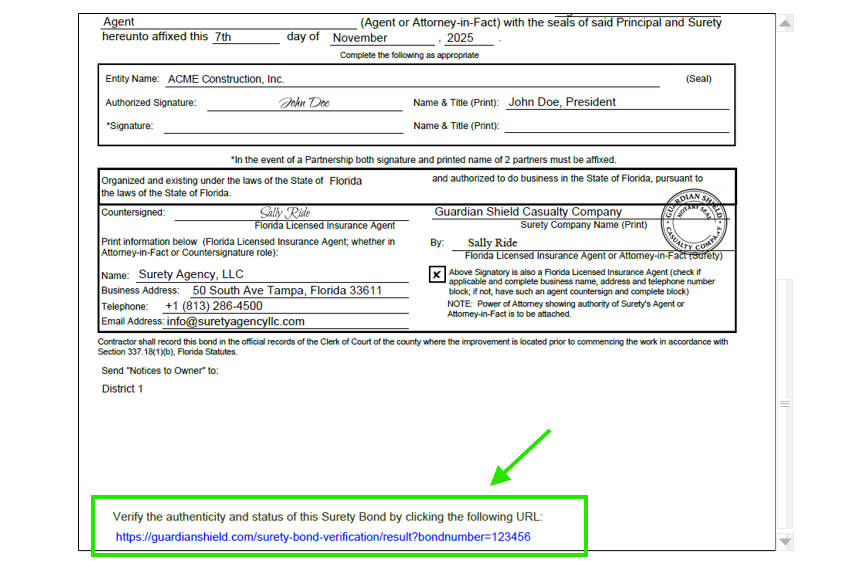

Verification Hyperlinks on Bond Documents

Insurers include a direct hyperlink within bond document sets that enables users to access the public bond verification page.

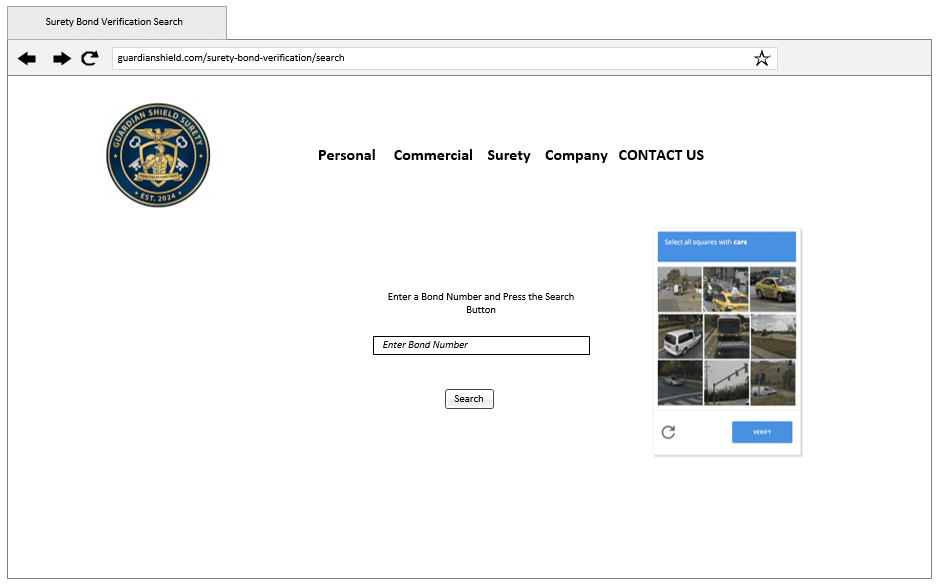

Search

Insurers also publish a surety bond search page on their public websites, allowing users to enter a bond number and locate the corresponding bond.

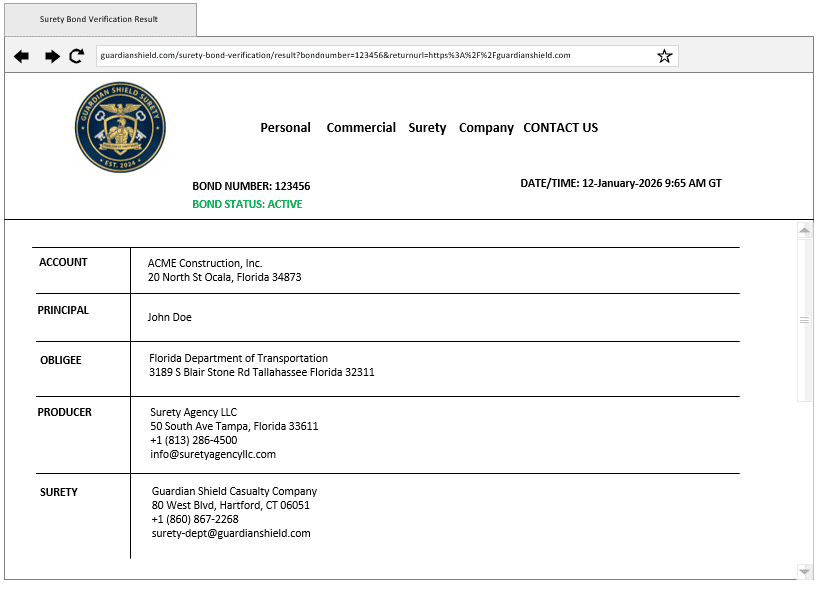

View

Bond verification summary and status information are presented to users using a default, uniform formatting pattern.

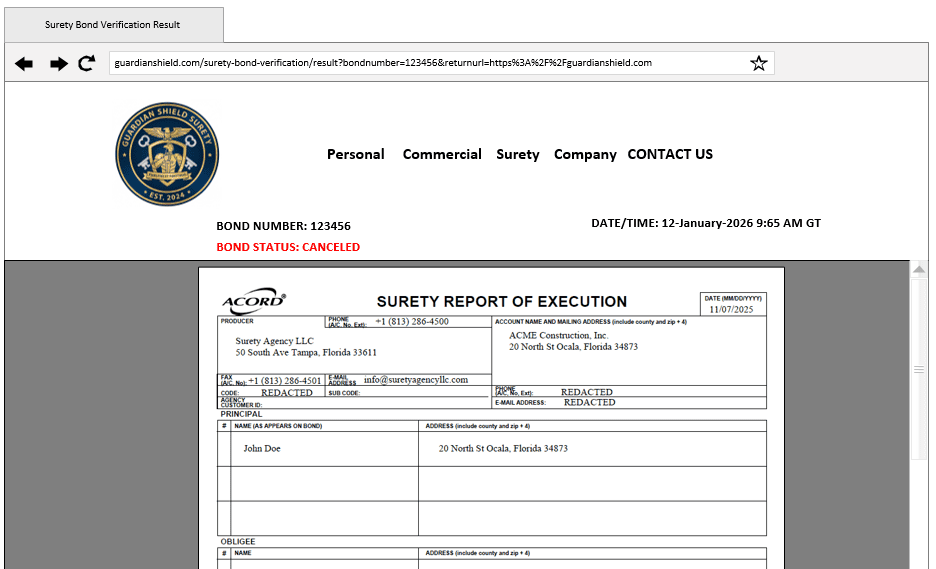

Alternate View Incorporating Existing Standards

Bond verification summary and status information are presented to users using the ACORD® Form 501 - Surety Report of Execution.

Search For Bonds On Any Website

Agencies, obligees, associations, and other third parties can publish public surety bond search pages that allow users to locate bonds by bond number. Provider selection (insurer or third‑party authenticator) is required until a Universal Surety Bond Number (USBN) is adopted.